SECURITIES AND EXCHANGE COMMISSION

________________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

________________________

Filed by the Registrant | x | |

| | |

Filed by the Registrant ý Filed by a Party other than the Registrant o Check the appropriate box: o Preliminary Proxy Statement o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ý Definitive Proxy Statement o Definitive Additional Materials o Soliciting Material Pursuant to § 240.14a-12

| | | | Professional Diversity Network, Inc. | | | (Name of Registrant as Specified In Its Charter) | | | | | | | | | (Name of Person(s) Filing Proxy Statement, if other than the RegistrantRegistrant) | o |

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

Professional Diversity Network, Inc.

(Name of Registrant as Specified In Its Charter)

________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | x | | ý | No fee required. | o | o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | | (1) | (1) | Title of each class of securities to which transaction applies: | | | | | | (2) | (2) | Aggregate number of securities to which transaction applies: | | | | | | (3) | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | | | | | | (4) | (4) | Proposed maximum aggregate value of transaction: | | | | | | (5) | (5) | Total fee paid: | | | | | o | o | Fee paid previously with preliminary materials. | o | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | | (1) | (1) | Amount previously paid: | | | | | | (2) | (2) | Form, Schedule or Registration Statement No.: | | | | | | (3) | (3) | Filing Party: | | | | | | (4) | (4) | Date Filed: | | | | |

August 26, 2016

![[c428172def14a001.jpg]](https://capedge.com/proxy/DEF 14A/0001214659-17-002857/c428172def14a001.jpg)

May 1, 2017

Dear Stockholder:

On behalf of the Board of Directors, I am pleased to invite you to attend the 2016 annual meeting2017 Annual Meeting of stockholdersStockholders of Professional Diversity Network, Inc. (the “Company”). The meeting will be held at the offices of the Company, located at 801 W. Adams Street, Suite 600,Sixth Floor, Chicago, Illinois 60607, on SeptemberJune 26, 2016,2017, at 11:9:00 a.m., Central Time. Annual Meeting Proposals

At the meeting, you and the other stockholders will be asked to vote on the proposals described in detail in the notice of meeting on the following page and the accompanying proxy statement, including the following matters: (i) the election of seven directors to hold office until the next annual meeting and until their successorsstatement. The proxy materials are duly elected and qualified; (ii) the ratification of the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; (iii) the approval of a series of alternate amendmentsbeing mailed to our certificate of incorporation, to effect, at the discretion of our Board of Directors, a reverse stock split of our common stock, whereby each outstanding 2 through 15 shares would be combined, converted and changed into one share of our common stock (the “Reverse Stock Split Proposal”) and to reduce proportionally the number of shares of common stock the Company is authorized to issue; and (iv) such other business as may properly be brought before the meeting or any adjournment or postponement thereof. Reverse Stock Split Proposal

We direct your attention to the discussion of our Reverse Stock Split Proposal in our proxy statement. Our common shares are currently listed on the Nasdaq Capital Market. However, as we have previously announced, we have received a delisting notice from the Nasdaq Stock Market for failing to comply with the continued listing requirement of maintaining a minimum bid price of at least $1.00 per share. In order to regain compliance, the closing bid price of our common stock must be at least $1.00 per share for a minimum of 10 consecutive business days prior to October 10, 2016. If we fail to satisfy this minimum bid price requirement before the October 10, 2016 deadline, our common stock will be delisted from the Nasdaq Capital Market. We believe it is in our stockholders’ best interests to maintain the listing of our common stock on the Nasdaq Capital Market.

As of August 25, 2016, the closing bid price of our common stock on the Nasdaq Capital Market was $0.72. Because we cannot be assured that we will meet the $1.00 minimum bid price requirement prior to October 10, 2016, we are asking our stockholders to approve the Reverse Stock Split Proposal. This Proposal authorizes our Board of Directors to file an amendment to our Certificate of Incorporation to effect a reverse stock split in a ratio ranging from 1-for-2 to 1-for-15, which means that each outstanding 2 through 15 shares would be combined, converted and changed into one share of our common stock. For complete information regarding the Reverse Stock Split Proposal, please review the proxy statement.

You and the other stockholders will not be asked to vote on the proposals related to the pending acquisition by Cosmic Forward Limited, a Republic of Seychelles company (“CFL”) of 51% of shares of our common stock on a fully diluted basis. You will receive separate materials with respect to a special meeting of stockholders to be held at a later date determined by our Board of Directors, to vote on such proposals.

Your Vote is Important

Please note that the Reverse Stock Split Proposal requires the affirmative vote of the holders of a majority of the outstanding shares of our common stock. As a result, your participation and vote at the annual meeting are important.

Whether or not you plan to attend the meeting, please vote electronically via the Internet, by telephone or by completing, signing, dating and returning the proxy card included with a paper copy of the proxy statement as promptly as possible. See the proxy statement for more details. Voting electronically or returning your proxy does NOT deprive you of your right to attend the meeting and to vote your shares in person for the matters acted upon at the meeting.

Thank you for your continued interest in the Company. We look forward to seeing you at the meeting.

| Sincerely, | | | | James Kirsch

Executive Chairman of the Board of Directors

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

On behalf of the Board of Directors, I am pleased to invite you to attend the 2016 annual meeting of stockholders of Professional Diversity Network, Inc. (the “Company”). The meeting will be heldrecord and beneficial owners at the offices of the Company, 801 W. Adams Street, Suite 600, Chicago, Illinois 60607, on September 26, 2016, at 11:00 a.m., Central Time. At the meeting you will be asked to:

| 1. | Elect seven directors to serve until the next annual meeting of stockholders (and until their successors are duly elected and qualified); |

| 2. | Ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016; |

| 3. | Authorize the Board of Directors to effect, in its discretion, a reverse stock split of the outstanding and treasury shares of the Company’s common stock in a ratio of [1-for-2] [1-for-3] [1-for-4] [1-for-5] [1-for-6] [1-for-7] [1-for-8] [1-for-9] [1-for-10] [1-for-11] [1-for-12] [1-for-13] [1-for-14] [1-for-15], to be determined by the Board of Directors, and to approve a corresponding amendment to the Company’s Certificate of Incorporation to effect the reverse stock split and to reduce proportionally the number of shares of common stock the Company is authorized to issue; and

|

| 4. | Transact such other business as may properly come before the 2016 annual meeting of stockholders and any adjournment or postponement thereof. |

You will not be asked to vote on the proposals related to the pending acquisition by Cosmic Forward Limited, a Republic of Seychelles company (“CFL”) of 51% of shares of our common stock on a fully diluted basis. You will receive separate materials with respect to a special meeting of stockholders to be held at a later date determined by our Board of Directors, to vote on such proposals.

The Board of Directors has fixed the close of business on August 4, 2016 as the record date for the determination of the holders of our common stock entitled to notice of and to voteMay 3, 2017 on all matters presented at the 2016 annual meeting of stockholders and at any adjournments or postponements.

about May 5, 2017.

It is important that your shares be represented and voted at the 2016 annual meeting of stockholdersAnnual Meeting regardless of the size of your holdings. Whether or not you plan to attend the meeting, please vote electronically via the Internet, by telephone or by completing, signing, dating and returning the proxy card included with a paper copy of the proxy statement as promptly as possible. See “Voting” in the proxy statement for more details. Voting electronically, by telephone or returning your proxy does NOT deprive you of your right to attend the meeting and to vote your shares in person for the matters acted upon at the meeting.

Thank you for your continued interest in the Company. We look forward to seeing you at the meeting.

| By Order of the Board of Directors | | Sincerely, | | James Kirsch | | | | /s/ Maoji (Michael) Wang | | Maoji (Michael) Wang | | | | Chief Executive ChairmanOfficer |

PROFESSIONAL DIVERSITY NETWORK, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 26, 2017

TO OUR STOCKHOLDERS:

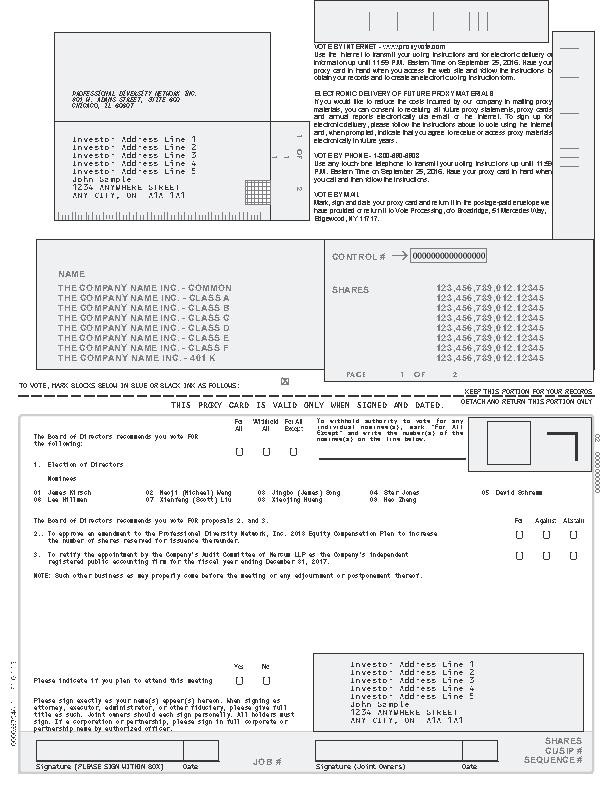

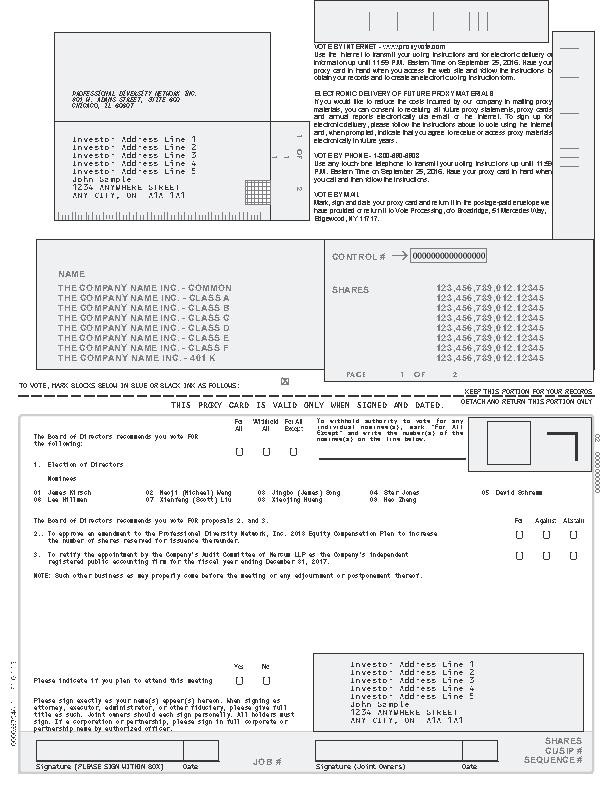

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Professional Diversity Network, Inc., a Delaware corporation (the “Company”), will be held at the offices of the Company, 801 W. Adams Street, Sixth Floor, Chicago, Illinois 60607, on June 26, 2017, at 9:00 a.m., Central Time, for the following purposes:

1. To elect nine directors to serve until the next Annual Meeting of Stockholders (and until their successors are duly elected and qualified);

2. To approve an amendment to the Professional Diversity Network, Inc. 2013 Equity Compensation Plan to increase the number of shares reserved for issuance from 225,000 to 615,000;

3. To ratify the appointment by the Company’s Audit Committee of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017; and

4. To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

The Board of Directors has fixed the close of business on May 3, 2017 as the record date for the determination of the holders of our common stock entitled to notice of and to vote on all matters presented at the Annual Meeting and at any adjournments or postponements.

A list of stockholders entitled to vote at the Annual Meeting will be open for examination by any stockholder for any purpose germane to the meeting during ordinary business hours for a period of ten days prior to the Annual Meeting at the offices of the Company, 801 W. Adams Street, Sixth Floor, Chicago, Illinois 60607, and will also be available for examination by any stockholder at the Annual Meeting until its adjournment.

Your vote is very important. Please submit your proxy as soon as possible by using the Internet, telephone or mail. Submitting your proxy by one of these methods will ensure your representation at the Annual Meeting regardless of whether you attend the meeting. Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy as described in proxy statement so that your vote will be counted if you are unable to attend the Annual Meeting.

Copies of the Board of Directors |

Chicago, Illinois

August 26, 2016

Notice Regarding Availability of Proxy Materials: Pursuant to the rules promulgated by the U.S. Securities and Exchange Commission, we have elected to provide access to our proxy materials by sending you this full set of proxy materials, including a proxy card, and notifying you of the availability of our proxy materials online.

Our proxy statement and of our Annual Report on Form 10-Kannual report for the fiscal year ended December 31, 2015, as amended,2016 are available online at www.proxyvote.com free of charge.

Except as stated otherwise, information on our website is not part of this proxy statement.

by visiting the following website: www.proxyvote.com.

| |

| By Order of the Board of Directors |

|

/s/ James Kirsch James Kirsch Executive Co-Chairman of the Board |

Chicago, Illinois

May 1, 2017

PROFESSIONAL DIVERSITY NETWORK, INC.

Professional Diversity Network, Inc.

801 W. Adams Street, Suite 600

Sixth Floor

Chicago, ILIllinois 60607

PROXY STATEMENT

Proxy Statement

ANNUAL MEETING

To Be Held on June 26, 2017

THE ANNUAL MEETING

The enclosed proxy is solicited by and on behalf of the board of directors (the “Board”) of Professional Diversity Network, Inc., a Delaware corporation (“Professional Diversity Network,” the “Company” or “PDN”), for use at Professional Diversity Network’s 2017 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on SeptemberJune 26, 2016

You are receiving this proxy statement because you own shares of our common stock that entitle you to vote2017 at the 2016 annual meeting of stockholders. Our Board of Directors is soliciting proxies from stockholders who wish to vote at the meeting. By use of a proxy, you can vote even if you do not attend the meeting. This proxy statement describes the matters on which you are being asked to vote and provides information on those matters so that you can make an informed decision. We intend to mail the notice of annual meeting, the proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as amended, on or about August 29, 2016.

Date, Time and Place of the 2016 Annual Meeting of Stockholders

We will hold the 2016 annual meeting of stockholders on September 26, 2016 at 11:9:00 a.m., Central Time, at our corporatethe offices located atof the Company, 801 W. Adams Street, Suite 600,Sixth Floor, Chicago, Illinois 60607.

Q: | Who can vote at the 2016 Annual Meeting of Stockholders? |

A: | Holders of our common stock at the close of business on August 4, 2016, are entitled to vote their shares at the 2016 annual meeting of stockholders. As of August 4, 2016, there were 14,510,960 shares of common stock issued, outstanding and entitled to vote. Each share of common stock issued and outstanding is entitled to one vote. |

Q: | What constitutes a quorum, and why is a quorum required? |

A: | We are required to have a quorum of stockholders present to conduct business at the meeting. The holders of record of a majority of the aggregate voting power of our common stock issued and outstanding and entitled to be voted, present in person or by proxy, will constitute a quorum for the transaction of business at the 2016 annual meeting of stockholders or any adjournment or postponement thereof. Proxies received but marked as abstentions, if any, and broker non-votes will be counted as present at the meeting for quorum purposes. If we do not have a quorum, we will be forced to reconvene the 2016 annual meeting of stockholders at a later date. |

Q: | What is the difference between a stockholder of record and a beneficial owner? |

A: | If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, Inc., you are considered the “stockholder of record” with respect to those shares. |

form of proxy to our stockholders will commence on or about May 5, 2017. This proxy statement and the form of proxy relating to the Annual Meeting will also be made available on the Internet to stockholders on the date that the proxy materials are first sent.

Record Date and Outstanding Shares

The Board has fixed the close of business on May 3, 2017 as the record date for the Annual Meeting (the “Record Date”).Only holders of record of the Company’scommon stock, $0.01 par value per share (“CommonStock”), at the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting. Each holder of Common Stock on the Record Date is entitled to one vote for each share on all matters to be voted upon at the Annual Meeting. As of the close of business on the Record Date, there were approximately 3,934,616 shares of Common Stock outstanding and entitled to vote.

Quorum and Vote Required

Quorum. The holders of record of a majority of the aggregate voting power of the Common Stock issued and outstanding and entitled to be voted, present in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting or any adjournment or postponement thereof. In the event there are not sufficient shares present to establish a quorum or to approve proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies by the Company.

1

Vote Required. Holders of Common Stock are entitled to one vote for each share held as of the Record Date on all matters to be voted on. In the election of directors (Proposal 1), the Board will be elected by a plurality of the voting power of the Common Stock represented in person or by proxy and entitled to vote at the Annual Meeting. Each stockholder is entitled to vote in favor or withhold his, her or its vote with respect to each individual nominee or all nominees. Votes that are withheld will have no effect on the outcome of the election of directors. The Company’s Bylaws provide that, except as otherwise provided by applicable law, the rules of the Nasdaq Stock Market, the Company’s Certificate of Incorporation or the Bylaws, all matters other than the election of directors will be decided by the vote of a majority in voting power of the shares present in person or by proxy and entitled to vote at the Annual Meeting and on the matter. The affirmative vote of a majority in voting power of the shares present in person or by proxy and entitled to vote at the Annual Meeting and on such proposal is required to approve Proposal 2 (Amendment of the Professional Diversity Network, Inc. 2013 Equity Compensation Plan) and Proposal 3 (Accounting Firm Ratification Proposal). None of the proposals are contingent upon the approval of any other proposal.

Abstentions. Abstentions will be counted for purposes of determining a quorum at the Annual Meeting. Abstentions are not considered votes cast and therefore will have no effect on the outcome of Proposal 1 (Election of Directors). Abstentions with respect to Proposal 2 (Amendment of the Professional Diversity Network, Inc. 2013 Equity Compensation Plan) and Proposal 3 (Ratifying the Selection of Marcum LLP) will have the same effect as a vote against such proposals.

Broker Discretionary Voting. If your shares are held in a brokerage account, by a brokerage firm, bank trustee or other agent (“nominee,”), you are considered the “beneficial owner”beneficial owner of shares held in street name.“street name,” and the proxy materials are being sent to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote. If you do not give instructions to your brokerage firm or bank, it will still be able to vote your shares with respect to “discretionary” proposals, but will not be allowed to vote your shares with respect to “non-discretionary” proposals. The Company expects that Proposal 3 (Ratifying the Selection of Marcum LLP) will be considered to be a discretionary proposal on which banks and brokerage firms may vote. The Company expects that all other proposals being presented to stockholders at the Annual Meeting will be considered to be non-discretionary items on which banks and brokerage firms may not vote. Therefore, if you do not instruct your broker or bank regarding how you would like your shares to be voted, your bank or brokerage firm will not be able to vote on your behalf with respect to these proposals. In the case of these non-discretionary items, the shares will be treated as “broker non-votes.” Broker non-votes are shares that are held in “street name” by followinga bank or brokerage firm that indicates on its proxy that it does not have discretionary authority to vote on a particular matter. Your failure to give instructions to your bank or broker will not affect the outcome of Proposal 1, because broker non-votes are not considered votes cast, nor the outcome of Proposal 2 or Proposal 3 because Proposal 2 and Proposal 3 require the affirmative vote of a majority in voting power of the shares present in person or by proxy and entitled to vote at the Annual Meeting and on these proposals and broker non-votes will not be deemed “entitled to vote on the proposal” and therefore broker non-votes are not counted in the vote for these proposals.

Shares Not Present in Person or by Proxy at the Annual Meeting. Shares not present in person or by proxy at the Annual Meeting will not be counted for purposes of determining a quorum at the Annual Meeting and will have no impact on the outcome of Proposal 1, Proposal 2 or Proposal 3.

Expenses of Proxy Solicitation

Officers, directors and other employees of the Company may solicit proxies in person or by regular mail, electronic mail, facsimile transmission or personal calls. These persons will receive no additional compensation for solicitation of proxies, but may be reimbursed for reasonable out-of-pocket expenses.

The Company will pay all of the expenses of soliciting proxies to be voted at the Annual Meeting. Banks, brokerage firms and other custodians, nominees or fiduciaries will be requested to forward soliciting material to their instructionsprincipals and to obtain authorization for the execution of proxies. They will be reimbursed for their reasonable out-of-pocket expenses incurred in that regard.

Voting Methods

Your vote is important. You may vote on the Internet, by telephone, by mail or by attending the Annual Meeting and voting by ballot, all as described below. If you vote by telephone or on the Internet, you do not need to return your proxy card or voting instruction card. Telephone and Internet voting facilities are available now and will be available 24 hours a day until 11:59 p.m., Eastern Time, on June 25, 2017.

2

Vote on the Internet

If you have Internet access, you may submit your proxy by going to www.proxyvote.com and following the instructions provided on the secure website. If you vote on the Internet, you do not have to mail in a proxy card.

Vote by Telephone

You can also vote by telephone by calling 1-800-690-6903. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. If you vote on by telephone, you do not have to mail in a proxy card.

Vote by Mail

If you choose to vote by mail, complete, sign and date the proxy card included with a paper copy of this proxy statement, and return it to the Company’s Secretary. Please allow sufficient time before the date of the Annual Meeting for mailing if you specifically request a copy ofdecide to vote by mail.

Vote at the printed materials from your nominee, you may use the voting instruction card provided by your nominee.

A: | If you are a stockholder of record, you may vote: |

| · | by mail, if you have received a paper copy of the proxy materials; or |

| · | in person at the meeting. |

Detailed instructions for voting via Internet, by telephone and by mail are set forth on your proxy card.

If you are a beneficial stockholder, you must follow the voting proceduresAnnual Meeting

The method or timing of your nominee. Ifvote will not limit your right to vote at the Annual Meeting if you attend the Annual Meeting and vote in person. However, if your shares are held byin the name of a bank, broker or other nominee, and you intendmust obtain a legal proxy, executed in your favor, from the holder of record to be able to vote at the meeting, please bringAnnual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the holder of record.

Street name holders may submit a proxy by telephone or the Internet if their bank or broker makes these methods available, in which case the bank or broker will enclose related instructions with this proxy statement. If you evidencesubmit a proxy by telephone or via the Internet you should not return the proxy card included with a paper copy of this proxy statement. If you hold your ownershipshares through a bank, broker or other nominee you should follow the voting instructions you receive from your bank, broker or other nominee.

Revocability of Proxy

If you are the holder of record for your shares, you may revoke your proxy at any time before it is exercised at the Annual Meeting by taking either of the following actions: (i) delivering to the Company’s Secretary a revocation of the proxy or a new proxy relating to the same shares and bearing a later date prior to the vote at the Annual Meeting; or (ii) attending the Annual Meeting and voting in person, although attendance at the Annual Meeting will not, by itself, revoke a proxy. Stockholders may also revoke a prior proxy submitted by telephone or on the internet by providing later voting instructions for voting of a later proxy prior to 11:59 P.M. Eastern Time the night of the last business day, June 25, 2017, before the date of the Annual Meeting.

Appraisal Rights

Stockholders have no appraisal rights with respect to any of the matters to be voted upon at the Annual Meeting.

Recommendation of the Board of Directors

The Board of Professional Diversity Network recommends that Professional Diversity Network stockholders vote FOR the election of each nominee for director (Proposal 1), FOR the amendment to the Professional Diversity Network, Inc. 2013 Equity Compensation Plan (Proposal 2) and FOR the ratification of the Company’s selection of Marcum LLP as the Company’s independent registered public accounting firm (Proposal 3).

3

PROPOSAL 1: NOMINATION AND ELECTION OF DIRECTORS

Nominees for Director

The Board has nominated the nine persons listed below to be elected as directors at the Annual Meeting. Directors are to be elected by a plurality vote of the voting power of the Common Stock present in person or by proxy at the Annual Meeting to serve until the next Annual Meeting and until their successors have been duly elected and qualified. All of the nominees are currently members of the Board.

The following table provides the name, age and position of each of our nominees of the Board as of the record date (suchof this proxy statement. There are no family relationships between our executive officers and directors.

| | |

Name | Age | Position |

James Kirsch | 55 | Executive Co-Chairman of the Board |

Maoji (Michael) Wang | 45 | Director and Chief Executive Officer |

Jingbo (James) Song | 63 | Executive Co-Chairman of the Board |

Star Jones | 55 | President and Director |

David Schramm | 67 | Director (1) (2) (3) |

Lee Hillman | 61 | Director (1) |

Scott Liu | 64 | Director (3) |

Xiaojing Huang | 60 | Director (2) |

Hao Zhang | 49 | Director (2) (3) |

(1)

Member of our audit committee.

(2)

Member of compensation committee.

(3)

Member of our nominating and corporate governance committee.

Set forth below is the name of each nominee for election to the Board, as well as each such person’s age, his or her current principal occupation (which has continued for at least the past five years unless otherwise indicated) together with the name and principal business of the company that employs such person, if any, the period during which such person has served as a letterdirector of the Company, all positions and offices that such person holds with the Company and such person’s directorships over the past five years in other companies with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or subject to the requirements of Section 15(d) of the Exchange Act or companies registered as an investment company under the Investment Company Act of 1940 and the specific experience, qualifications, attributes or skills that led to the conclusion that such person should serve as a director of the Company.

James Kirsch has served as our Executive Co-Chairman of the Board since November 2016. He previously served as our Chief Executive Officer and Chairman of the Board from your nominee confirming your ownership or a bank or brokerage firm account statement)the consummation of our initial public offering in March 2013 until March 2016 and, prior to our initial public offering, served as our Chief Executive Officer and a legal proxymember of our management board since 2008. Mr. Kirsch served as Chief Strategic Officer at AMightyRiver.com, a division of the Company from your nominee authorizing you2004 to vote your shares.

A: | At the 2016 annual meeting of stockholders you will be asked to vote on the following proposals. Our Board recommendation for each of these proposals is set forth below. |

| | |

Proposal | | Board Recommendation |

| |

1. To elect seven directors to serve until the next annual meeting of stockholders (and until their successors are duly elected and qualified). | | FOR each director nominee |

| |

2. To ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016. | | FOR |

| |

3. Authorize the Board of Directors to effect, in its discretion, a reverse stock split of the outstanding and treasury shares of the Company’s common stock in a ratio of [1-for-2] [1-for-3] [1-for-4] [1-for-5] [1-for-6] [1-for-7] [1-for-8] [1-for-9] [1-for-10] [1-for-11] [1-for-12] [1-for-13] [1-for-14] [1-for-15], to be determined by the Board of Directors, and to approve a corresponding amendment to the Company’s Certificate of Incorporation to effect the reverse stock split and to reduce proportionally the number of shares of common stock the Company is authorized to issue.

| | FOR |

2008 and from 1996 to 2001 as Chief Executive Officer of eSpecialty Brands, an online retail company. Previously, Mr. Kirsch served as Chief Executive Officer at iMaternity.com, the ecommerce partner of iVillage.com from 1983 to 1996 and Manager, Vice President and Chief Operating Officer at Dan Howard Industries, a vertically integrated retailer of apparel. He holds a B.S. in Economics and Political Science from University of Arizona. We will also consider other business that properly comes before the meeting in accordance with Delaware law and our bylaws.

You will not be asked to vote on the proposals relatedbelieve Mr. Kirsch is a valuable asset to the pending acquisition byBoard because of his experience and vision in leading the Company since 2008.

Maoji (Michael) Wang has been our Chief Executive Officer and a member of the Board since November 2016. He is also an investor in Cosmic Forward Limited (“CFL”), the Company’s majority stockholder and is currently the managing partner of Beijing Daqian Law Firm, and has held that position since November 2005. Mr. Wang has also served as a Republicvice president at GNet Group Plc, an e-commerce company based in China, since April 2014, and as Chief Executive Officer of Seychelles company (“CFL”)Tibet Weibai Investment Fund Management Co., Ltd. since March 2016, Guangzhou Gaixin Network Technology Development Co., Ltd. since May 2016 and Guangzhou Yougaojiu Marketing Management Co., Ltd. since June 2016. He has also worked as a supervisor at Guangzhou Wu Wei E-commerce Services Co., Ltd. since January 2015 and Yunnan Linkenuodi Education Information Consulting Co., Ltd. since November 2012. Mr. Wang was originally appointed to our Board and has been nominated to stand for reelection as a director on our Board under the terms of 51%a stockholders’ agreement entered into between the Company and CFL, our majority stockholder, which agreement grants to CFL the right to designate one director nominee for every 9.9% of sharesthe total voting power of our common stock on a fully diluted basis. You will receive separate materials with respectthat CFL beneficially owns, up to a special meetingmaximum of stockholderssix directors.

4

Jingbo (James) Song has been a member of the Board and its Executive Co-Chairman since November 2016. He has served as Chairman of GNet Group Plc., an e-commerce company based in China, since March 2016. Before joining GNet Group Plc., Mr. Song was retired. Mr. Songwas originally appointed to be heldour Board and has been nominated to stand for reelection as a director on our Board under the terms of a stockholders’ agreement entered into between the Company and CFL, our majority stockholder, which agreement grants to CFL the right to designate one director nominee for every 9.9% of the total voting power of our common stock that CFL beneficially owns, up to a maximum of six directors.

Star Jones has been our President and a member of the Board since September 2014. She joined NAPW’s predecessor company in September 2011 as its National Spokesperson and became its Chief Development Officer in May 2013 and President in June 2014. Ms. Jones became the “face” of NAPW, tasked with conveying the message, brand and image of NAPW worldwide. As President, she has responsibility for the overall development, expansion and implementation of NAPW’s development and programming strategy. For the last 25 years, Ms. Jones has been a licensed attorney in the State of New York and was formerly a New York homicide prosecutor. Ms. Jones has worked in television for more than 20 years as a journalist, talk show host, commentator, NBC News Legal Correspondent and Veteran Legal Analyst and co-host of ABC’s The View for nine years. She is also regularly seen on NBC’s Today Show and CNN’s Piers Morgan Live as a veteran law and news analyst. Ms. Jones is also an accomplished author who has written two best-selling non-fiction books, You Have to Stand for Something, or You’ll Fall for Anything and Shine...a Physical, Emotional & Spiritual Journey to Finding Love. Her third book, Satan’s Sisters, a fictional account of the behind-the-scenes workings of a daytime talk show, was published in the spring of 2011. In the corporate world, Ms. Jones has been a featured personality for numerous consumer brands including Payless, Saks Fifth Avenue and Kohls, and has appeared on the cover of and/or been featured in a number of major newspapers and magazines in the country on topics ranging from news to lifestyle. Her newest venture, Status, by Star Jones, a collection of women’s apparel for the professional woman, was launched by QVC in the fall of 2013. Since 2011, she has actively participated in the American Heart Association’s National Go Red efforts, has lobbied Congress on behalf of that association and was asked by the Presidential Inaugural Committee to speak at the National Day of Service on heart health during President Obama’s 2013 Inauguration. As the National Volunteer for the American Heart Association, Ms. Jones led NAPW in its efforts to help raise awareness of heart disease during “Heart Month,” helping to raise millions of dollars for much needed research and community outreach. Ms. Jones was selected to serve as a later date determined by ourdirector based on her substantial leadership and networking abilities, as well as her in-depth knowledge of the business of NAPW.

Lee Hillman has been a member of the Board since July 2016. He has served as the CEO of Performance Health Systems, LLC, or its predecessor, a business manufacturing and distributing PowerPlate® and bioDensity™ branded, specialty health and exercise equipment, since 2009. Mr. Hillman has also served as President of Liberation Advisory Group and Liberation Management Services, LLC since 2003. Mr. Hillman currently serves as a member of the Board of Directors to vote on such proposals.

Q: | What happens if additional matters are presented atHC2 Holdings, Inc., a diversified holding company engaged in acquiring and growing businesses in the United States and internationally. He also serves as a member of the 2016 Annual Meeting of Stockholders? |

A: | Other than the items of business described in this proxy statement, we are not aware of any other business to be acted upon at the 2016 annual meeting of stockholders. If you grant a proxy, the persons named as proxy holders, James Kirsch and Katherine Butkevich, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting in accordance with Delaware law and our bylaws.

You will not be asked to vote on the proposals related to the pending acquisition by CFL of 51% of shares of our common stock on a fully diluted basis. You will receive separate materials with respect to a special meeting of stockholders to be held at a later date determined by our Board of Directors, to vote on such proposals.

|

Q: | What if I abstain on a proposal? |

A: | If you sign and return your proxy marked “abstain” on any proposal, your shares will not be voted on that proposal. However, your shares will be counted for purposes of determining whether a quorum is present. |

Q: | What is the required vote for approval of each of the proposals in this proxy statement? |

A: | Proposal | | Vote Required for Approval | |

| | | |

| 1. Election of Directors | | Plurality of shares present and entitled to vote | |

| | | |

| 2. Ratification of Auditor | | Majority of shares present and entitled to vote | |

| | | |

| 3. Authorization of the Reverse Stock Split and Approval of a Corresponding Amendment to the Certificate of Incorporation to Effect the Reverse Split | | Majority of outstanding shares entitled to vote | |

Election of Directors and as lead independent director of Lawson Products, Inc., where he also serves as Chair of the Compensation Committee. Mr. Hillman also serves as a Trustee of Adelphia Recovery Trust and as a director of Business Development Corporation of America. He serves as a member of the Audit Committee of each of the aforementioned boards. Mr. Hillman is a certified public accountant and former audit partner with Ernst & Young, LLP. Mr. Hillman’s experience as a chief executive officer, chief financial officer and/or a director of other public U.S. and international companies and as a former audit partner of an international accounting firm provides valuable insights to our Board. Mr. Hillman has previously served as a director of public companies which include Lawson Products (NASDAQ: LAWS), HC2 (NASDAQ: HCHC), and Adelphia Recovery Trust (formerly traded OTC).

David Schramm has been a member of the Board since July 2016. Mr. Schramm is currently retired. He currently serves as a member of the Board of Directors of Capacitor Science. From 2014 to 2016, Mr. Schramm served as advisor to the Board of Directors of Maxwell Technologies, Inc., a developer, manufacturer and marketer of energy storage and power delivery products for transportation, industrial, information technology and other applications and microelectronic products for space and satellite applications. From 2007 until 2013, Mr. Schramm was President and CEO of Maxwell Technologies, Inc. From 2001 to 2006, he was president and chief executive officer of Arrowhead Products Corp., a leading supplier of specialty systems to the aerospace and automotive industries. Previously, he spent the bulk of his business career in a series of senior management and engineering positions with General Motors. Mr. Schramm is a Certified Governance Fellow by the NACD and brings to the Board his extensive managerial experience and expertise in a broad range of board oversight matters.

5

Xianfang (Scott) Liu has been a member of the Board since November 2016. Mr. Liu has been a professor and Director of the Center for International Business Studies at the New York Institute of Technology (NYIT) since September 1997. Since September 2008, Mr. Liu has also served as Executive Associate Dean for Global Programs at NYIT. From December 2006 to September 2008, he also served as Dean of the School of Management at NYIT.Mr. Liuwas originally appointed to our Board and has been nominated to stand for reelection as a director on our Board under the terms of a stockholders’ agreement entered into between the Company and CFL, our majority stockholder, which agreement grants to CFL the right to designate one director nominee for every 9.9% of the total voting power of our common stock that CFL beneficially owns, up to a maximum of six directors.

Xiaojing (Tammy) Huang has been a member of the Board since November 2016. Ms. Huang was a senior consultant at Shaklee (China) Co., Ltd., a manufacturer and distributor of personal care products based in China, from September 2005 to September 2016. Ms. Huangwas originally appointed to our Board and has been nominated to stand for reelection as a director on our Board under the terms of a stockholders’ agreement entered into between the Company and CFL, our majority stockholder, which agreement grants to CFL the right to designate one director nominee for every 9.9% of the total voting power of our common stock that CFL beneficially owns, up to a maximum of six directors.

Hao (Howard) Zhang has been a member of the Board since November 2016. Mr. Zhang is a private investor based in China. Mr. Zhang has served as a director of Wealth Power Global Trading Limited since June 2015. Mr. Zhangwas originally appointed to our Board and has been nominated to stand for reelection as a director on our Board under the terms of a stockholders’ agreement entered into between the Company and CFL, our majority stockholder, which agreement grants to CFL the right to designate one director nominee for every 9.9% of the total voting power of our common stock that CFL beneficially owns, up to a maximum of six directors.

Required Vote

In order to be elected to the Board, each nominee must receive a plurality of the voting power of the Company’s common stockCommon Stock present in person or represented by proxy at the 2016 annual meeting of stockholders and entitled to vote on the election of directors. This means that the director nominees who receive the highest number of votes “FOR” their election are elected.Annual Meeting. Stockholders may only vote “FOR”for or withhold their votes with respect tofor the election of the nominees to the Board. Votes that are withheld and broker non-votes, if any, will be counted for purposes of determining the presence or absence of a quorum. Votes that are withheld, abstentions and broker non-votes will have no effect on the election of directors. Unless instructions to the contrary are specified, as permitted by applicable law and the rules of the Nasdaq Stock Market, the proxy holders will vote the proxies received by them “FOR” each of the director nominees.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF ALL OF THE NOMINEES AS DIRECTORS.

CORPORATE GOVERNANCE

Meetings and Committees of the Board of Directors

The Board has constituted an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee.

Audit Committee. The Audit Committee was established for the purpose of overseeing the Company’s accounting and financial reporting processes and audits of the Company’s financial statements. The Audit Committee met on four occasions in 2016 and operates under a charter approved by the Board. The Audit Committee’

s primary functions are:

·

to assist the Board with the oversight of the Company’s financial reporting process, accounting functions and internal controls; and

·

the appointment, compensation, retention and oversight of the work of any registered public auditing firm employed by the Company for the purpose of preparing or issuing an audit report or related work.

6

The Audit Committee currently consists of Lee Hillman (Audit Committee Chair) and David Schramm, each of whom are independent under the rules of the NASDAQ Stock Exchange. The Audit Committee meets periodically with the Company’s independent registered public accounting firm, both with and without management present. The Board has determined that Mr. Hillman is an “audit committee financial expert” within the meaning of Item 407 of Regulation S-K under the Exchange Act. A copy of the Audit Committee charter is posted and available on the Corporate Governance link of the Investor Relations section of the Company’s website, www.prodivnet.com. Information on the Company’s website is not incorporated by reference in this proxy statement.

Compensation Committee. The Compensation Committee met on two occasions in 2016 and operates under a charter approved by the Board. The Compensation Committee’s primary functions are:

·

annually reviewing and approving corporate goals and objectives relevant to Chief Executive Officer compensation, evaluating the Chief Executive Officer’s performance in light of those goals and objectives, and recommending to the Board the Chief Executive Officer’s overall compensation levels based on this evaluation;

·

annually reviewing and approving the annual base salaries and annual incentive opportunities of the Chief Executive Officer and the other executive officers;

·

reviewing and approving the following as they affect the Chief Executive Officer and the other executive officers: (a) all other incentive awards and opportunities, including both cash-based and equity-based awards and opportunities; (b) any employment agreements and severance arrangements; and (c) any change-in-control agreements and change-in-control provisions affecting any elements of compensation and benefits; and

·

monitoring and evaluating matters relating to the compensation and benefits structure of the Company as the Compensation Committee deems appropriate, including: (a) providing guidance to senior management on significant issues affecting compensation philosophy or policy and (b) evaluating whether the risks arising from the Company’s compensation policies and practices for its employees would be reasonably likely to have a material adverse effect on the Company.

The Compensation Committee currently consists of David Schramm (Compensation Committee Chair), Xiaojing (Tammy) Huang and Hao (Howard) Zhang. The Compensation Committee also has authority to delegate its responsibilities to a subcommittee. The Company and the Compensation Committee may, from time to time, directly retain the services of consultants or other experts to assist the Company or the Compensation Committee, as the case may be, in connection with executive compensation matters. During the fiscal year ended December 31, 2016, the Compensation Committee engaged Meridian Compensation Partners, LLC to consult regarding executive officer and director compensation for the period beginning January 1, 2017. The Compensation Committee does not believe the risks from the Company’s compensation policies and practices for its employees would be reasonably likely to have a material adverse effect on the Company.

A copy of the Compensation Committee charter is posted and available on the Corporate Governance link of the Investor Relations section of the Company’s website, www.prodivnet.com. Information on the Company’s website is not incorporated by reference in this proxy statement.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee met on two occasions in 2016 and operates under a charter approved by the Board. The Nominating and Corporate Governance Committee’s primary functions are:

·

leading the search for individuals qualified to serve as members of the Board and conducting the appropriate inquiries with respect to such persons;

·

evaluating the size and composition of the Board and its committees and recommending any changes to the Board;

·

reviewing the qualifications of, and making recommendations regarding, director nominations submitted to the Company by shareholders;

7

·

reviewing the Board’s committee structure and recommending to the Board for its approval directors to serve as members of each committee; and

·

reviewing and recommending committee slates annually and recommending additional committee members to fill vacancies as needed.

The Nominating and Corporate Governance Committee currently consists of David Schramm (Nominating and Corporate Governance Committee Chair), Xianfang (Scott) Liu and Hao (Howard) Zhang. A copy of the charter of the Nominating and Corporate Governance Committee is posted and available on the Corporate Governance link of the Investor Relations section of the Company’s website, www.prodivnet.com. Information on the Company’s website is not incorporated by reference in this proxy statement.

Attendance at Board and Committee Meetings

During the fiscal year ended December 31, 2014, the Board held a total of 19 meetings. Each member of the Board, other than Daniel Marovitz, Stephen Pemberton, Andrea Saenz, Randi Zuckerberg and Donna Brazile (each of whom was replaced on the Board during 2016), attended 80% or more of the meetings of the Board and of the committees of which the director was a member during the fiscal year ended December 31, 2016. The Company does not have a policy regarding director attendance at Annual Meetings of stockholders, however, all directors are strongly encouraged to attend.

Director Independence

Our Board has reviewed the materiality of any relationship that each of our directors has with us, either directly or indirectly. Based on this review, our board has determined that Messrs. Hillman, Schramm, Liu and Zhang and Ms. Huang are “independent directors” as defined by Rule 5605(a)(2) of the Marketplace Rules of the Nasdaq Stock Market. Under the terms of a stockholders’ agreement entered into between the Company and CFL, our majority stockholder, CFL has right to designate one director nominee for every 9.9% of the total voting power of our common stock that CFL beneficially owns, up to a maximum of six directors.

Board Leadership Structure

The Board does not have a policy requiring that the roles of Chief Executive Officer and Chairman of the Board (or Co-Chairmen of the Board) be separate. The Board believes that the Company and its stockholders benefit when the Board is free to determine the most appropriate leadership structure in light of the experience, skills and availability of directors and the Chief Executive Officer as well as other circumstances. From January 1, 2016 through March 30, 2016, Mr. Kirsch served as the Chairman of the Board and the Chief Executive Officer. The Board believes this was the most appropriate structure for the Company at that time because it made the best use of the experience, skills and availability of Mr. Kirsch. From March 31, 2016 through November 6, 2016, Mr. Kirsch served as the Chairman of the Board but not as Chief Executive Officer, and from November 7, 2016 through December 31, 2016 Mr. Kirsch and Mr. Song served as Executive Co-Chairmen of the Board. Additionally, because five of the Company’s nine Board members have been determined by the Board to be “independent,” the Board believes that its current structure provides sufficient independent oversight of management given the Company’s current size, and therefore, the Board has not designated a lead independent director.

Board’s Role in Management of Risk

The Company faces numerous risks more fully described in the Company’s annual and quarterly reports filed with the SEC. The Company’s management bears responsibility for the day-to-day management of risks the Company faces and for communicating the most material risks to the Board and its committees. The Board, as a whole and through its committees, is responsible for company-wide oversight of risk management. The Board and its committees perform their risk management function principally through the receipt of regular reports from management and discussions with management regarding risk assessment and risk management. In its risk oversight role, the Board is responsible for satisfying itself that the risk management processes described and implemented by management are adequate and functioning as designed.

Board Nominee Process

The Board has adopted a Nominating and Corporate Governance Committee Charter, which includes the Company’s general director nomination policies.

8

The Nominating and Corporate Governance Committee (the “Nominating Committee”) believes that it is in the best interest of the Company and its stockholders to obtain highly-qualified candidates to serve as members of the Board. In addition to any past or future policies adopted by the Board, with respect to director nominations, the Nominating Committee will consider any additional factors as it deems appropriate to assist in developing a Board and committees that are diverse in nature and comprised of experienced and seasoned advisors. These factors may include decision-making ability, judgment, personal integrity and reputation, experience with businesses and other organizations of comparable size, experience as an executive with a publicly traded company and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board.

The Nominating Committee Charter specifically requires the Nominating Committee to develop a Board that reflects diversity among its members. The Nominating Committee is able to assess the effectiveness of the Company’s policy regarding diversity through its regular, required monitoring of the composition of the Board and its committees. Further, in connection with such regular monitoring, the Nominating Committee Charter specifically requires the Nominating Committee to determine whether it may be appropriate to add individuals with different backgrounds or skills to the Board.

The Nominating Committee may use multiple sources for identifying director candidates, including its own contacts and referrals from other directors, members of management, the Company’s advisors and executive search firms. The Nominating and Corporate Governance Committee will also consider director candidates recommended by stockholders in accordance with the procedures governing such recommendations in the Company’s bylaws and will evaluate such director candidates in the same manner in which it evaluates candidates recommended by other sources.

Stockholder Communication with the Board of Directors

Stockholders may communicate with one or more directors or the Board as a whole by sending written communications addressed to such person or persons to the Secretary, Professional Diversity Network, Inc., 801 W. Adams Street, Sixth Floor, Chicago, Illinois 60607, or by sending electronic mail to investor@prodivnet.com. All communications will be compiled by the Secretary and relayed to the applicable director or directors.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The code of business conduct and ethics is available on our corporate website at www.prodivnet.com. Any amendment to, or waiver from, a provision of such code of ethics will be posted on our website. Information on the Company’s website is not incorporated by reference in this proxy statement.

Certain Relationships and Related Party Transactions

The following is a summary of transactions, since January 1, 2016, to which we have been a party in which the amount involved exceeded the lesser of $120,000 or 1% of the average of our total assets at December 31, 2015 and December 31, 2016, and in which any of our directors, executive officers, beneficial holders of more than 5% of our capital stock or certain other related persons had or will have a direct or indirect material interest, other than compensation arrangements that are described under the section of this proxy statement entitled “Executive Compensation.”

Transactions with Matthew Proman

On November 4, 2016, the Company entered into a Confidential Settlement and Mutual Release of All Claims (the “Release”) with Matthew B. Proman, then the beneficial holder of approximately 15.7% of our outstanding common stock, and a former officer and director of the Company. Pursuant to the Release, the Company and Mr. Proman agreed among other things that (i) the Company would pay to Mr. Proman $300,000 at the closing of the November 2016 transaction with CFL, (ii) the Separation Agreement and Mutual Release of All Claims, dated July 16, 2015 between Mr. Proman and PDN (the “Separation Agreement”) would be terminated as of November 4, 2016, and (iii) the Seller Promissory Note in the principal amount of $445,000 dated September 24, 2014 in favor of Mr. Proman (the “Promissory Note”) would be terminated as of November 4, 2016. The Company and Mr. Proman have also agreed that notwithstanding the termination of the Separation Agreement pursuant to the Release, Mr. Proman’s co-sale right is preserved and he continues to hold the options and warrants he held as of November 4, 2016.

9

Transactions with White Winston

In March of 2016, the Company entered into a Master Credit Facility (the “Credit Agreement”) with White Winston Select Asset Funds, LLC (“White Winston”) under which White Winston provided a revolving credit facility (in the original principal amount up to $5,000,000. At the time that the Company entered into the Credit Agreement, White Winston was not a related party of the Company. The Credit Agreement was terminated on November 7, 2017.

In connection with the closing of the Credit Agreement, we issued three warrants to White Winston: (i) a warrant (the “Fixed $2.00 Warrant”) to purchase up to 125,000 shares of our common stock at an exercise price of $2.00 per share, (ii) a warrant (the “Pro Rata Warrant”) to purchase at an exercise price of $2.00 per share a certain number of shares of our common stock, up to 218,750 shares, pro rata based on the ratio of the actual advances made under the Master Credit Facility to the maximum principal amount of the Master Credit Facility, and (iii) a warrant (the “Fixed $20 Warrant,” and together with the Fixed $2.00 Warrant and the Pro Rata Warrant, the “Warrants”) to purchase up to 125,000 shares of our common stock at an exercise price of $20 per share. The Fixed $2.00 Warrant and the Pro Rata Warrant are exercisable for five years from the date of issuance and the Fixed $20 Warrant is exercisable for five years beginning on December 30, 2016. As a result of the issuance of the Warrants, under the rules of the SEC, White Winston became the beneficial owner of 15.8% of our outstanding common stock.

In connection with the closing of the Credit Agreement, we also entered into a Board Representation Agreement (the “Board Representation Agreement”) with White Winston. Under the Board Representation Agreement, we granted White Winston the right to designate nominees for election to our Board from the date the principal amount outstanding under the Credit Agreement first exceeds $2,000,000 until such time as White Winston’s ownership interest in our common stock (calculated pursuant to the terms of the Board Representation Agreement) falls below five percent for 60 consecutive days. Pursuant to the terms of the Board Representation Agreement, White Winston also received the right, subject to certain exceptions, to purchase a portion of any shares of common stock and any warrants, options, debentures or other securities exercisable or exchangeable for or convertible into shares of common stock offered for sale by us. The number of new securities White Winston was entitled to purchase were to be determined pursuant to the terms of the Board Representation Agreement in proportion to White Winston’s interest.

On August 10, 2016, we and our wholly-owned subsidiaries, NAPW, Inc., Noble Voice LLC and Compliant Lead LLC, entered into an Amendment to Master Credit Facility and Consent and Waiver Agreement (the “Amendment”) with White Winston. Pursuant to the Amendment, White Winston consented to the acquisition of our common stock by CFL and the other transactions contemplated by the purchase agreement with CFL and waived its participation rights and board representation rights under the Board Representation Agreement in connection therewith. In consideration for the Amendment, we agreed that the Pro Rata Warrant would be fully exercisable, notwithstanding the pro rata formula set forth in the Warrant, and paid a fee of $15,000. In addition, White Winston granted us an option to repurchase its outstanding, in-the-money Warrants following the consummation of part of the transaction by which CFL became our majority stockholder on the terms set forth in the Amendment.

We were also a party to a Consulting and Monitoring Agreement (the “Consulting Agreement”) with White Winston, pursuant to which we paid to White Winston a monthly monitoring fee at White Winston’s hourly rate and agreed to reimburse White Winston for all reasonable and necessary out of pocket fees and expenses. As of September 30, 2016, we had paid $138,325 to White Winston under the Consulting Agreement.

On November 7, 2016, in connection with the closing of the initial issuance of shares to CFL, we (i) repaid in full amounts owed under the Credit Agreement and (ii) terminated the Credit Agreement and related agreements between us and White Winston, including the Board Representation Agreement. All security interests created under the Credit Agreement were released upon repayment of the amounts due under and the termination of the Master Credit Facility.

Stockholders’ Agreement. As previously disclosed, in November 2016, we concluded a transaction with CFL pursuant to a stock purchase agreement, the result of which was that CFL became our majority stockholder. At time of the closing of such transaction with CFL, we also entered into a stockholders’ agreement (as amended, the “Stockholders’ Agreement”)with CFL and each of its shareholders: Maoji (Michael) Wang, Jingbo Song, Yong Xiong Zheng and Nan Nan Kou (collectively, the “CFL Shareholders”). The Stockholders’ Agreement sets forth the agreement of the Company, CFL and the CFL Shareholders relating to board representation rights, transfer restrictions, standstill provisions, voting, registration rights and other matters following the closing of the November transaction between CFL and the Company.

10

Under the Stockholders’ Agreement, the CFL Shareholders and their respective controlled affiliates (collectively, the “CFL Group”) are prohibited from directly or indirectly acquiring, agreeing to acquire or publicly proposing or offering to acquire any shares of Common Stock directly from PDN or commencing any tender offer or exchange offer for any shares of common stock, in each case which would cause the aggregate beneficial ownership of members of the CFL Group to exceed 54.64% of the then outstanding shares of Common Stock, on a fully-diluted basis. In addition, members of the CFL Group are prohibited from directly or indirectly acquiring, agreeing to acquire or publicly proposing or offering to acquire directly or indirectly, or commencing any tender offer or exchange offer for, any other capital stock or debt securities of the Company. Any common stock or rights to acquire common stock granted to an affiliate of CFL or a CFL Shareholder in his or her capacity as an employee, director or officer of the Company pursuant to a board-approved compensation or equity plan are excluded from this beneficial ownership cap and are to be excluded from the calculation of the beneficial ownership of members of the CFL Group.

Notwithstanding the foregoing, members of the CFL Group have the right to make open market purchases or privately-negotiated purchases from the Company’s stockholders of additional shares of common stock up to any amount, provided that, as a result of such purchases, the Company does not have fewer than 350 stockholders, thus preventing the CFL Group from causing the Company to fall below the number of stockholders required to maintain a listing on the NASDAQ Capital Market.

For so long as members of the CFL Group beneficially own at least 25% of our outstanding shares of common stock, CFL and the CFL Shareholders have a participation right with respect to any future issuances of our common stock, such that CFL and the CFL Shareholders may purchase an amount of shares necessary to maintain its then-current beneficial ownership interest, up to a maximum of 54.64% of our then-outstanding Common Stock, on a fully-diluted basis, subject to certain exceptions. This participation right does not apply to any issuance by the Company:

·

as consideration in any merger, acquisition or similar strategic transaction approved by the Board;

·

to directors, officers or employees, advisors or consultants pursuant to a compensation, incentive or similar plan approved by the Board;

·

as a result of the conversion of convertible securities or the exercise of any warrants, options or other rights to acquire PDN’s capital stock; or

·

in an “at the market offering” or other continuous offering of equity securities by PDN.

This participation right also does not apply to the extent that, as a result of the exercise thereof, CFL and the CFL Shareholders would beneficially own greater than 54.64% of PDN’s then outstanding Common Stock, on a fully-diluted basis.

The Stockholders’ Agreement contains standstill provisions that, among other things and subject to certain exceptions, prohibit members of the CFL Group from, directly or indirectly:

·

facilitating, knowingly encouraging, inducing, supporting or becoming a “participant” in, or a member of certain “groups” (as defined in Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) formed for the purposes of acting with respect to, any solicitation of proxies or consents with respect to any proposal submitted to the holders of our voting securities for their consideration, vote or consent, other than any such proposal included in the Company’s definitive proxy statement including the affirmative recommendation of the Board or any committee thereof;

·

submitting, inducing, facilitating or knowingly encouraging the making or submission by any person or entity to the Board, management or any of our security holders, any proposal or offer providing for or contemplating any merger, acquisition, sale, lease, mortgage, encumbrance or pledge or other transfer of all or a material portion of the assets of, business combination, amalgamation, share exchange, tender or exchange offer, recapitalization, reorganization, spin-off, issuance or sale or purchase or shares of any class of capital stock, dissolution, liquidation or winding up, or any similar transaction, in each case, involving the Company’s or any of its subsidiaries’ securities, assets or businesses, except for an acquisition proposal for all of the outstanding common stock satisfying the conditions described below; or

11

·

taking any action, directly or indirectly, to change the composition of the Board or its committees such that they no longer satisfy NASDAQ Listing Rule 5605 regarding board and committee independence.

These restrictions generally do not prohibit members of the CFL Group from:

·

making a bona fide acquisition proposal or offer to the Company to acquire all outstanding shares of Common Stock not then beneficially owned by members of the CFL Group, provided such proposal contemplates the acquisition of all shares of Common Stock for 100% cash consideration and is expressly and irrevocably conditioned at the time the proposal is made on the approval of both a committee (a “Special Committee”) of the Board comprised solely of independent directors, a majority of which are not CFL Board Designees (as defined below; currently Mr. Hillman and Mr. Schramm) and the affirmative vote of a majority of the outstanding shares of Common Stock not then beneficially owned by the CFL Group; or

·

transferring their shares of Common Stock in connection with a third-party tender offer or a third-party business combination proposal, provided that:

o

such third-party tender offer or proposal was not commenced or conducted as a result of a breach of the standstill provisions of the Stockholders’ Agreement; and

o

no such transfer shall be permitted during the one-year period following the closing of the Share Issuance (the “Lock-Up Period”) unless the third-party tender offer or proposal has been approved and recommended by a Special Committee or by the Board (including the affirmative vote of a majority of the independent directors, which majority includes at least one independent director that is not a CFL Board Designee).

The Stockholders’ Agreement provides for certain restrictions on the ability of members of the CFL Group to transfer their shares of Common Stock during the Lock-Up Period. However, members of the CFL Group are permitted to transfer shares of Common Stock to:

·

CFL, one or more CFL Shareholders, any of their respective controlled affiliates, or, in the case of the CFL Shareholders, certain of its family members;

·

certain third-parties as discussed above;

·

to PDN or any of its subsidiaries; or

·

in any transaction approved in advance by the Special Committee or the Board (including the affirmative vote of a majority of the independent directors, which majority includes at least one independent director that is not a CFL Board Designee).

Notwithstanding these restrictions, during the Lock-Up Period, members of the CFL Group may transfer shares of Common Stock at any time, in a single transaction or in multiple transactions, provided the aggregate number of shares transferred may not exceed 10% of the outstanding shares of Common Stock. In addition, as noted above, members of the CFL Group may transfer their shares of Common Stock during the Lock-Up Period in connection with a third-party tender offer or third-party business combination proposal.

Following the expiration of the Lock-Up Period, members of the CFL Group may transfer their shares of Common Stock without restriction under the Stockholders’ Agreement, provided that, as a result of such transfers, no single transferee acquires beneficial ownership of more than 14.9% of the then-outstanding outstanding shares of Common Stock.

CFL and the CFL Shareholders may transfer or issue capital stock of CFL to any party, as long as the CFL Shareholders continue to own a majority of the outstanding capital stock and voting power of CFL.

12

Under the Stockholders’ Agreement, CFL and the CFL Shareholders have the right to nominate individuals reasonably acceptable to the Nominating and Governance Committee of the Board for election as directors of PDN (the “CFL Board Designees”), for so long as the CFL Group beneficially owns at least 9.9% of PDN’s total voting power. For purposes of the Stockholders’ Agreement, “total voting power” means the total number of votes represented by and entitled to be cast by holders of PDN’s outstanding voting securities.

CFL has the right to nominate one director nominee for every 9.9% of total voting power that the CFL Group beneficially owns, provided that, under the Stockholders’ Agreement, CFL will not have the right to nominate more than six directors regardless of how many shares of Common Stock it beneficially owns. CFL and the CFL Shareholders may assign the right to designate a director to any third party to whom CFL or a CFL Shareholder sells 9.9% of the total voting power.

For so long as the Stockholders’ Agreement is in effect, the size of the Board will be fixed at nine directors.

In addition, unless otherwise approved by the Board (including the affirmative vote of a majority of the independent directors then on the Board, which majority includes at least one independent director that is not a CFL Board Designee), PDN will not utilize any controlled company exceptions to the corporate governance requirements under NASDAQ rules. As CFL’s board designation rights decrease, so do the number of CFL Board Designees that must be independent. Specifically, if CFL has the right to designate:

·

Five or six CFL Board Designees, then three must be independent;

·

four CFL Board Designees, then two must be independent;

·

three CFL Board Designees, then one must be independent; and

·

fewer than three CFL Board Designees, then CFL will not be required to designate any independent directors.

At least one CFL Board Designee will serve on each committee of the Board. Consistent with the Stockholders’ Agreement and as described in Item 5.02 below, at the closing of the Share Issuance, the Board appointed Jim Kirsch and Jingbo Song as co-Chairmen of the Board. If Mr. Kirsch is no longer serving on the Board, then there will be no co-Chairmanship, and Mr. Song or another CFL Board Designee will be the sole Chairman of the Board. Board Chairmanship will be designated by CFL for so long as CFL has board designation rights under the Stockholders’ Agreement.

PDN will maintain directors’ and officers’ liability insurance for the benefit of each CFL Board Designee on substantially similar terms, conditions and amounts as its current insurance policy, and shall provide the CFL Board Designees with all benefits as currently provided to other directors performing similar roles.

CFL and the CFL Shareholders must cause all of the shares of Common Stock held by the CFL Group to be present for quorum purposes at every meeting of PDN’s stockholders. In addition, CFL and the CFL Shareholders will cause all of the shares of Common Stock held by the CFL Group to be voted (i) “for” the election of all director nominees approved and recommended by the Board, for so long as PDN is in material compliance with the Stockholders’ Agreement and (ii) “against” any proposal that would have the effect of circumventing the Stockholders’ Agreement.

Pursuant to the Stockholders’ Agreement, following the expiration of the Lock-Up Period, CFL and the CFL Shareholders have unlimited demand, shelf and piggyback registration rights to require PDN to effect a registration under the Securities Act of a resale of the shares of Common Stock acquired by CFL at the closing of the Share Issuance and any other shares of Common Stock acquired by CFL or the CFL Shareholders following the closing.

CFL and the CFL Shareholders have the right to require PDN to file a registration statement every 120 days, and PDN has the right, once per twelve-month period, to delay such filing up to 120 days. PDN is required to use commercially reasonable efforts to cause the registration statement to become effective. PDN is precluded from granting any registration rights to any party in the future that would adversely impact CFL’s registration rights.

13

PDN, on the one hand, and CFL and the CFL Shareholders, on the other hand, agreed to indemnify each other for any material misstatements or omissions in any registration statement filed pursuant to the registration rights provisions of the Stockholders’ Agreement, provided that the indemnity obligations of CFL and the CFL Shareholders will cover only information provided by them expressly for inclusion in the registration statement and is limited to the amount of net proceeds received by CFL and the CFL Shareholders in the offering to which the registration statement relates.

The registration rights of CFL and the CFL Shareholders under the Stockholders’ Agreement terminate when CFL or the CFL Shareholder, as applicable, no longer holds “registrable securities.” For purposes of the Stockholders’ Agreement, “registrable securities” means:

·

any shares of Common Stock issued to, purchased or acquired by CFL or a CFL Shareholder (other than in violation of the Stockholders’ Agreement); and

·

any of PDN’s securities issued or issuable to CFL or a CFL Shareholder with respect to any shares of Common Stock (including, by way of stock dividend, stock split, distribution, exchange, combination, merger, recapitalization, reorganization or otherwise).

Any particular registrable securities once issued shall cease to be “registrable securities” upon the earliest to occur of:

·

the date on which such securities are disposed of pursuant to an effective registration statement under the Securities Act;

·

the date on which such securities are disposed of pursuant to Rule 144 (or any successor provision) promulgated under Securities Act;

·

the date on which such securities may be sold without volume limitations or manner of sale restrictions pursuant to Rule 144 (or any successor provision) promulgated under the Securities Act (without the requirement that we be in compliance with the current public information requirement of such rule);

·